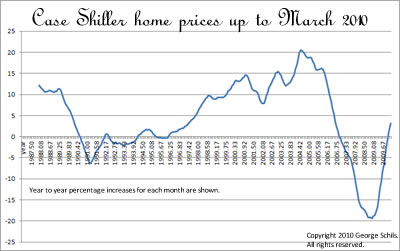

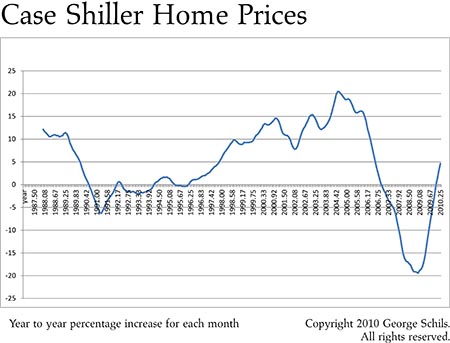

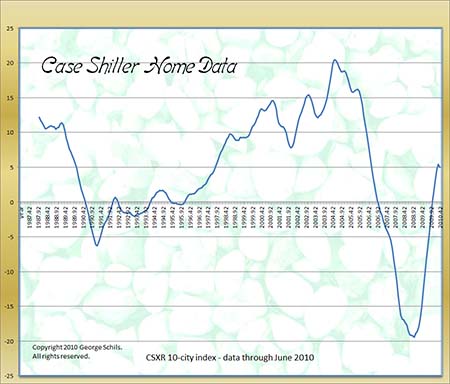

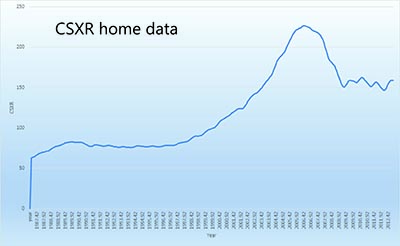

Case Shiller (part of Standard and Poors) provides nice housing data. Case Shiller home price index reports are found here. This pdf document has some nice graphs of recent housing price trends.

Home prices increased by 1.4% from May to June 2009, according to recent Case Shiller data.

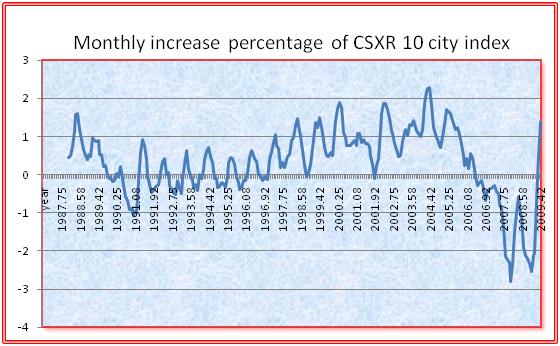

Here we use the CSXR 10 city index. This index showed a month to month percentage increase in home prices of 1.40%, and that the year to year increase was -15.13% (from June 2008 to June 2009).

The graph below shows the percentage month to month changes in the CSXR index. These are monthly percentages and are not annualized. It seems clear that home prices are on the increase again. A respectable increase is seen at the right side of the graph.

The 1.4% monthly increase translates to a very high yearly percentage. The real interesting question is what next month's data will show.