This brief blog post gives the results of some random walk studies

applied to the stock market. In particular, a segment of S&P 500 stock

market data is used for the analysis. The question is how does the

stock market data compare to a random walk. To answer this question,

the power spectrum is computed for a segment of stock market data. It

is known that the power spectrum of a random walk decreases as the

square

of the frequency. The analysis that we do computes the power

spectrum of a section of S&P 500 data, and compares the fall off

over

frequency with that of a random walk.

I am using the terminology "ramdom walk" to mean Brownian

motion,

and I may be a bit sloppy in using this term.

Even though I use the term "random walk" in this post, a

better term would be "Brownian motion".

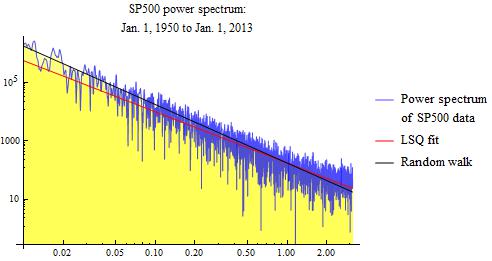

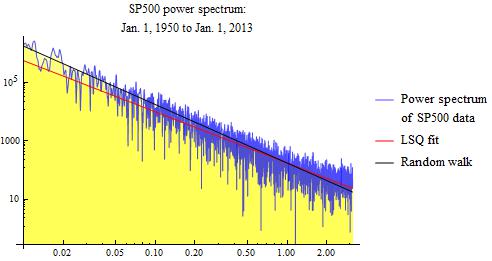

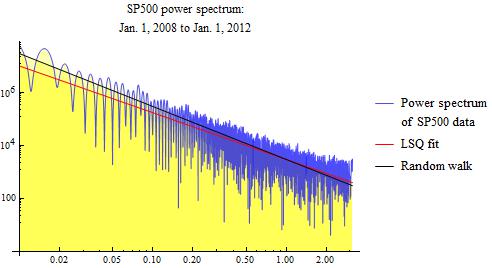

The first analysis that we do is for a time starting on January 1,

1950 and extending to January 1, 2013. The S&P 500 data over this

period is used as input for the spectral analysis. The graphic below

shows the result of the sample power spectrum, and also shows the

ideal result for a pure random walk. The pure random walk has a power

spectrum characteristic shown by the solid blue line. The sample power

spectrum is shown as the jagged blue line. Because it is a sample

spectrum, and not an average spectrum, one would expect it to be

somewhat jittery, as we observe. It is observed that the sample power

spectrum from the S&P 500 data closely follows the solid blue line for

a pure random walk. Tentatively, this illustrates that the S&P 500 stock

market data is very much that of a pure random walk. This is over the

63 year analysis period.

In the above log-log

plot, the solid blue line has a slope of -2. This means

that the spectrum falls off at a rate proportional to the square of

the frequency. This is the power spectrum of an ideal random walk. It

is seen to correspond closely to the sample spectrum for the S&P 500

data.

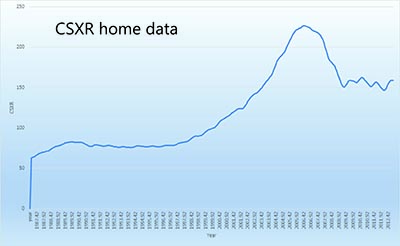

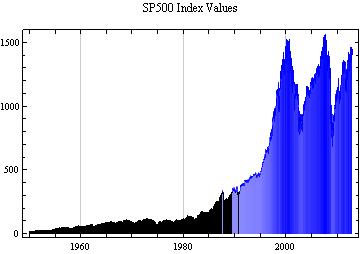

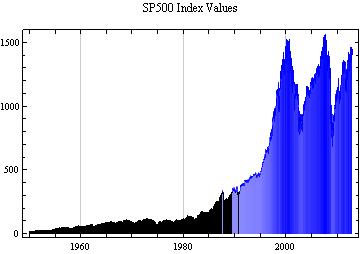

The actual data used in this analysis is given in the graphic

below. This is the value of the S&P 500 index over the period of 63

years, extending from the year 1950 to the year 2013.

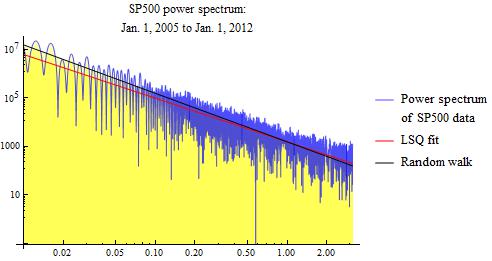

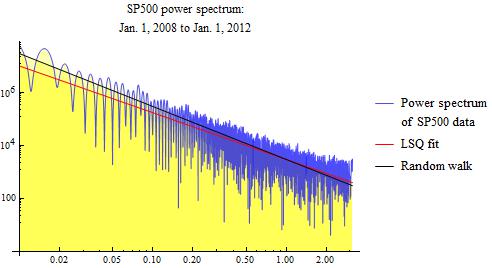

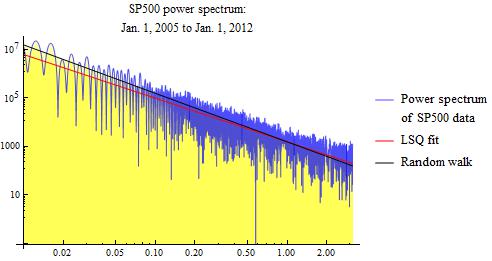

The basic result that stock market data follows a random walk appears

not to depend strongly on the analysis period. We show results for two

additional analysis periods. First, we look at data from 2005 to

2012. Secondly, we look at data from 2008 to 2012.

A random walk is a lot like a drunk staggering down the street.

This

article

discusses some humorous aspects of this phenomenon.

The red line in the above power spectrum graphs is a least squares

fit. This red line is a naive least squares fit, and can be subject to

various errors. The slopes that I get for this least squares fit range

from about -1.5 to -1.75, whereas pure Brownian motion has a value of

-2.

If these slopes are correct, it would

indicate fractional Brownian

motion.

The results discussed above

are tentative. There are many technical issues

that are beyond the scope of this article.

Related references:

1,

2,

3,

4.

Update 2