Treasury note data is as of

5:22 p.m. EDT 10/16/08

(Treasuries data is from WSJ.com.)

1-Month Bill* 2/32 0.091

3-Month Bill* 8/32 0.497

6-Month Bill* 8/32 1.147

2-Year Note* -5/32 1.637

5-Year Note* -5/32 2.852

10-YR Note* -6/32 3.970

30-Year Bond* -1 1/32 4.254

It is interesting that the 1-month note bears an interest

rate of near zero.

Even though the short term inter-rate bank lending rate is very

high, the Federal rate is near zero.

The Fed has been pushing down short term interest rates by

instrumenting rate cuts. They keep pushing down the short end

when it rises and this keeps the yield curve from inverting.

Yield curve inversion, which we do not have here, is one

indication of a recession.

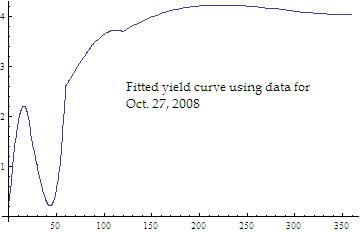

The yield curve using data points is shown below.

And the fitted curve is given next.